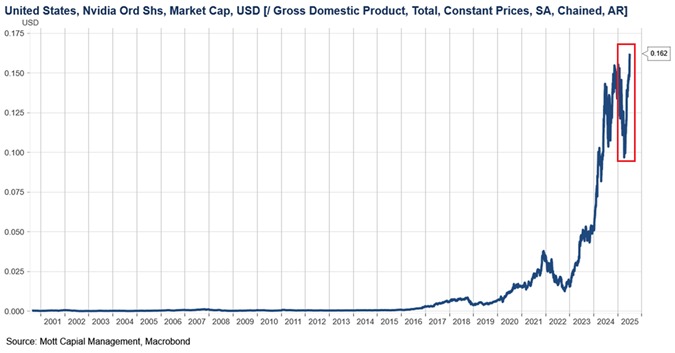

https://medium.com/@hrnews1/the-value-of-nvidia-now-exceeds-an-unprecedented-16-of-u-s-gdp-ede4b541b24c Sixteen percent of GDP. Think about that number.

The United States has tethered 16% of its entire economic output to the fortunes of a single company. Not an industry. Not a sector. One company. NVIDIA.

This isn’t diversification. It’s not even speculation. It’s national self-delusion dressed up as innovation.

America has done this before. We worshiped General Motors until it collapsed. We inflated the dot-com bubble until it burst. We built an entire financial system on subprime mortgages until 2008 taught us otherwise. We learned nothing…. NVIDIA’s Unchecked Dominance

NVIDIA makes graphics processing units. They’re very good at it. Their chips power AI models, crypto mining operations, and cloud datacenters. The company’s market capitalization has surged to over $5 trillion.

Wall Street cheers. Politicians brag about American technological superiority. NVIDIA’s CEO becomes a rockstar.

But here’s the truth: concentrated market dominance is not strength. It’s fragility masquerading as power.

NVIDIA controls between 80% and 95% of the market for AI chips used for training and deploying models. Their H100 and A100 processors are the gold standard for training large language models. Every major tech company — Microsoft, Google, Amazon, Meta — depends on their hardware.

This isn’t resilience. It’s a single point of failure with a stock ticker.

Revenue concentration tells the story. NVIDIA’s datacenter segment accounts for over 88% of total revenue. Remove AI hype from the equation and you’re looking at a company propped up by speculative frenzy, not diversified industrial strength. The Dangerous Over-Leverage of the U.S. Economy

Sixteen percent of GDP.

Let me say it differently: If NVIDIA stumbles, America doesn’t just lose a tech darling. It loses jobs, investments, pension funds, and the entire AI narrative Wall Street has been selling.

The ripple effects would be catastrophic. Tech slowdown. Financial contagion. Investor panic. The kind of systemic shock that makes 2008 look like a practice run.

And what’s America’s backup plan? There isn’t one.

We’ve bet the economy on corporate hubris rather than building diversified industrial capacity. We’ve confused market capitalization with national security. We’ve treated stock prices as a measure of geopolitical strength. It’s reckless. It’s stupid. And it’s quintessentially American.

No other advanced economy would tolerate this level of concentration. Germany doesn’t pin 16% of its GDP on Siemens. Japan doesn’t hinge its future on Toyota. Even China, for all its centralized planning, spreads risk across multiple state champions.

But America? We put all our chips on one chipmaker and call it genius. Supply Chain Fragility and Geopolitical Shortsightedness

NVIDIA doesn’t manufacture its own chips. Taiwan Semiconductor Manufacturing Company does. TSMC produces an estimated 90% of the world’s super-advanced semiconductor chips, and more than 90% of the most advanced chips globally are manufactured in Taiwan.

Taiwan. An island 100 miles from mainland China. A territory Beijing considers its own. The most geopolitically volatile piece of real estate on the planet.

This is where America has decided to anchor its technological future.

TSMC’s most advanced facilities are in Hsinchu and Tainan. If China moves on Taiwan — through blockade, invasion, or economic coercion — those fabs go offline. NVIDIA’s supply chain evaporates. America’s AI ambitions collapse overnight.

And China knows this.

Beijing is pouring resources into semiconductor self-sufficiency. SMIC, Huawei, and other Chinese firms are reverse-engineering NVIDIA’s architecture, with Huawei’s Kirin 9000S processor — produced in SMIC factories — providing tangible proof that China can produce advanced chips locally despite embargoes.

Analysts project China will achieve a true 5nm-based chip by 2025 or 2026. SMIC is approximately a handful of years behind TSMC in process technology.

Five years. That’s the gap between American dominance and Chinese parity.

Export controls won’t save us. Sanctions won’t stop reverse engineering. The U.S. can restrict NVIDIA from selling advanced chips to China, but it can’t prevent Chinese engineers from studying, replicating, and eventually surpassing American designs.

History is littered with technological monopolies that thought they were untouchable. Britain dominated textiles until America stole the designs. America led in consumer electronics until Japan refined the process. Japan ruled semiconductors until Korea and Taiwan built better fabs.

Overconfidence breeds catastrophe. Always has. Always will. Market Myopia and Investor Complacency

NVIDIA’s price-to-earnings ratio has fluctuated wildly, hitting levels that would make even dot-com speculators blush. At its peak, the company traded at over 70 times earnings.

This isn’t valuation. It’s religion.

Investors assume AI demand is infinite. They believe NVIDIA’s dominance is permanent. They think American tech exceptionalism is a law of nature rather than a temporary advantage.

They’re wrong.

China’s chip industry is advancing faster than Western analysts predicted. Reports indicate Chinese companies are achieving 5nm chip production using deep ultraviolet lithography without access to extreme ultraviolet equipment.

The gap is closing. And when it closes, NVIDIA’s moat disappears.

American investors are complacent. They see NVIDIA’s stock price and assume supremacy. They ignore competitive threats until it’s too late. They confuse market hype with sustainable advantage.

It’s the same myopia that convinced investors pets.com was worth billions. The same delusion that made Enron look invincible. The same arrogance that inflated every bubble in American financial history.

Where is America’s industrial policy? Where’s the strategic planning? Where’s the diversification?

Nowhere.

Washington reacts to crises. It doesn’t prevent them. The CHIPS Act allocated $52 billion for semiconductor manufacturing — a pittance compared to the scale of the problem. It’s a band-aid on a hemorrhage.

Meanwhile, China created the China Integrated Circuit Investment Industry Fund to channel an estimated $150 billion in state funding to support domestic industry. South Korea and Taiwan have invested hundreds of billions more.

America is being outspent, outplanned, and outmaneuvered. And yet, policymakers still assume tech dominance is our birthright.

Anti-trust enforcement is toothless. Strategic planning is non-existent. Industrial diversification is treated as anti-market heresy.

The result? America has a “too-big-to-fail” tech company that nobody wants to regulate, nobody wants to challenge, and everybody assumes will last forever.

We’ve been here before. AT&T. IBM. Microsoft. All seemed invincible until they weren’t.

The difference now? NVIDIA isn’t just a monopoly. It’s a systemic risk. And nobody in Washington seems to care.

Sixteen percent of GDP…The United States has tethered 16% of its entire economic output to the fortunes of a single company

That’s not really how that works. Those two numbers aren’t comparable to each other. Nvidia’s market capitalization, what investors are willing to pay for ownership of the company, is equal to sixteen percent of US GDP, the total annual economic activity in the US.

They’re both dollar values, but it’s like comparing the value of my car to my annual income.

You could say that the value of a company is somewhat-linked to the expected value of its future annual profit, which is loosely linked to its future annual revenue, which is at least more connected to GDP, but that’s not going to be anything like a 1:1 ratio, either.

The United States has tethered 16% of its entire economic output to the fortunes of a single company

Yeah, this article should compare nVidia’s revenue to the US GDP (both measure of annual production). But we know why they aren’t, as it wouldn’t produce an alarming stat.

The United States has tethered 16% of its entire economic output to the fortunes of a single company

And to be clear, this stat is simply factually wrong. nVidia IS NOT 16% of US output. They sold $165B last year, US GDP is $29.2T. This means the US has tethered… 0.5% of their economic output to one company. Not 16%, zero-point-five-percent.

Yeah, this article should compare nVidia’s revenue to the US GDP (both measure of annual production). But we know why they aren’t, as it wouldn’t produce an alarming stat.

Not really, because Nvidia’s revenue is far less exorbitant than its market cap. I’m not sure why c/technology is suddenly a dumping ground for every random Medium blog, which is as trustworthy a news source as somebody’s Facebook feed.

The AI bubble will pop, but will likely be more like the doctom crash than the 2008 one. It isn’t as interconnected with the rest of the economy.

I’m not sure why c/technology is suddenly a dumping ground for every random Medium blog, which is as trustworthy a news source as somebody’s Facebook feed.

It’s not exactly random. That blog is run by the poster, who is rather on my “users here to push an agenda” list.

I generally agree with you, except I don’t think we can speculate whether it will be like 2008 the dot-com bubble.

The world economy is different from what it was ~25 years ago. I believe the reliance on index type funds has increased at a drastic rate.

There is also things like the relative concentration of AI-influenced stocks.

Another new piece is America becoming much more corrupt. Americans might not care about this, but it would be naive to think this would not have a caustic effect in the medium term on the real world.

Mind you, I am not necessarily saying I know the correct answer, just pointing out some things to consider.

I believe the reliance on index type funds has increased at a drastic rate.

Very good point, although this will disproportionately harm regular folks like us, and the people in charge don’t really care about that so it won’t be as disruptive as somebody important (like a bank or a hedge fund, neither of which rely on index funds) getting into financial trouble.

The AI bubble will pop, but will likely be more like the doctom crash than the 2008 one. It isn’t as interconnected with the rest of the economy.

This is going to age like milk.

The dotcom crash was no joke. Most people here weren’t around for it (as adults at least) so they brush it off. I’m not saying this next crash won’t be bad, I’m saying it won’t have the knock-on liquidity effects of 2008.

What you aren’t taking into account how much the US social safety net has hollowed out since the dotcom crash.

This is going to be very bad, I wouldn’t waste words speculating about the extent of the damage, we haven’t seen this kind of shock hit such a fragile US society. There is no resilience left in the US people to climb out of a big economic crash, things will just shatter.

The dotcom crash was a process of a period of vibrant growth and opportunity smashing into a wall, this is different… this is much worse, it is like a runner already in terrible shape collapsing in the middle of a marathon from their body shutting down, AI is just the acute symptom of a much more worrying disease where the ruling class is attempting to hallucinate itself out of the consequences of their divestment from any functional social safety for the rest of the country.

You may be right, but I hope you aren’t.

Still, 1/200 of the country with the biggest military is a large amount for a single company.

So, the US GDP is about $30T. Walmart revenue is about $700B, or 2.3% of GDP. Amazon, 2.1%. United Healthcare, 1.3%. Roughly one out of every 20 dollars spent in the US goes to Walmart or Amazon. That’s kind of terrifying.

The original source was much more sensible.

The comparison makes sense for evaluating whether you’re over-invested in something. Like, if Nvidia suddenly poofed out of existence, would it seriously be worth 16% of everything the whole country makes in a year to get it back?

Owning a car that’s worth 16% of your yearly income sounds reasonable, no matter what your actual income is. A Pokemon card collection that’s 16% of your income is probably too risky, no matter what your actual income is.

Also, GDP is a decent scale to use for charting investment in a productivity tool, because if GDP ramped up at the same time as investment then it looks less like a bubble, even if they both ramp up quickly.

But that’s not what we see. We see a sudden and volatile shift, nothing like the normal pattern before the hype.

They’re both dollar values, but it’s like comparing the value of my car to my annual income.

The thing that every bank does in order to decide if they should give you more money?

And if the us government were lending someone money to buy Nvidia, that may be relevant.

Get that first week of Macroecon 101 shit out of here before I go into outrage withdrawal.

RAGE!

lol

Thank you. I mean what??? The phrasing is idiotic. This company has a large market cap, therefore the US has “tethered its economic output” to it? What’s that even supposed to mean?

I want to make a clarification here before we all get too far ahead with “16% of GDP”. There are many things wrong with the way giant tech companies dominate their respective fields. However the value of a company does not equal its’ share of the GDP. GDP is the OUTPUT of a country in 1 year. It does not equal the value of all the private enterprises combined which is what this comparison is trying to do. What we want to compare then, is to take NVIDIA’s output in ONE YEAR and see how much of the economy it dominates. US GDP is ~ 30 trillion in 2025. Nvidia’s output or revenue for current fiscal year is ~ $200 billion. That’s 0.6% of the GDP. That’s far cry from 16%, by about 27 times less.

What we should be concerned are the size of the market cap of these giant tech companies dominating the total value of the stock market, as well as the monopolistic margins these companies enjoy. All of these contribute to the imbalances in the world we see today - in the economies, in the society and social structure, and in politics. Communism once rose two centuries ago in protest against the concentration of power in the hands of a few. A solution is needed to remedy the imbalances of today.

Thank you, I came here to complain about the false equivalence between entire company value and sum of all trades for a country in a year

Y’all realize it’s actually a worse sign that way, right?

No, market capital is usually far higher than revenue

To a certain extent, sure, duh.

But hey, you trust the stock, all in on it buddy.

You’ll hit the moon for sure.

No idea why you think you have to be condescending and make ridiculous assumptions. I don’t trust the stock, nor do I hold it. I am explaining definitions of simple market variables and if you want to be rude about it then that says a lot about your character

condescendingly explains the most basic of concepts

gets offended when they’re mocked in turn

Yes, thank you. A lot of people live in a house that’s worth more than they make in a year. We can write a breathless sentence that makes this sound shocking if we like.

“Think about that number. You have tethered 450% of your economic output to the fortunes of one structure!”

There is no solution i think. The entire economic system is about creating those imbalances. In other words, monopolies are the end goal of capitalism, for the companies.

I mean, unless you want to constrain unlimited capitalism but America is not about that. Europe is doing that.

The rich people in America now are practically running the country and its decisions. I dont think there is a solution when people have become that powerful and rich.

but that contradicts the great justification for capitalism: efficient markets. Monopolies are the exact opposite of efficient markets.

Are they? I see monopolies everywhere and they seem super efficient for bringing in billions of dollars to the owners, which in turn becomes incredibly powerful and influencial people. Their decisions affect the entire planet now.

What is the definition of an efficient market?

If you trust Adam Smith, an efficient market would quickly make new goods and services available for the lowest possible price. People are supposed to be incentivised to sell things, and competition is supposed to stop an excessive amount of money being diverted to profits instead of reinvestment and price cuts. There are supposed to be systems in place that ensure that there are always opportunities for competition, but the wealthiest have the most power to erode those mechanisms and the most interest in eroding them, and neoliberals think an Ayn Rand novel is the definitive text on how capitalism works rather than Adam Smith’s work, so even if you land in the capitalism makes everyone better off mode, it doesn’t last for long before it falls back into fuedalism with extra steps mode.

Yeah. I remember reading about Adam Smith in school, and it made perfect sense then. But after seeing the actual world, it seems it just falls apart.

Nvidia doesn’t make GPUs. TSMC does.

Nvida just sends them their design specs.

Apple, Google, Nvidia, etc. - all TSMC in Taiwan. A country that China would love to occupy given a good motivator.

They don’t need any additional motivation at this point, generations of mainland Chinese have been brainwashed into believing that Taiwan is their land, despite that not being the case for centuries.

All they need is an opportunity to open up, where western militaries are occupied elsewhere, such as Europe after a Russian attack on NATO, the US gets pulled in to the Middle East again or the South American war crimes that Trump is doing becomes a much larger war. As soon as they think nobody will come to Taiwan’s aid they will invade.

And Taiwan is set to blow their chip factories if invaded. Not an official policy, but it’s a no-brainer.

Centuries?

its all a distraction from thier internal problems: population decline, lack of jobs for many graduates,etc.

china isnt going to be realistically be able to take the island, and the chip factory, because those factories would likely be destroyed prior to china trying invade,

Boy, when that AI bubble pops it’s gonna pop like a nuclear explosion.

It is, blessedly so. Maybe this will take the electricity-gobbling AI data centers off line and my power bill will go down.

the problem is, that it will take down a whole bunch of completely unrelated industries as a fallout of this

I don’t cry for industry, I cry for the workers who constantly and disproportionately bear the brunt of the failures of industry leaders. Unregulated capitalism makes slaves of us all. And, we keep letting them do it for their forever unfulfilled promises and fearmongering.

Hopefully the lesson learned from cramming a product based on a bubble of hype into everything on the market is not to do that again.

Oh yeah, this is probably the bubble that will finally make the capitalists act rationally.

-Everyone in 2008, 2002, 2000, 1990, 1987, 1980, 1973, 1968, 1937, 1929, 2025

Bold of you to assume that anyone will learn any lesson at all.

Remember the Tulips? We’re not good at learning long term lessons.

The “lesson” will be that the truly wealthy will stay so, and the rest of us will be pushed farther away, the discrepancy between our stations will diverge even further, and the relative wealth of the tippy top will increase just that much more. Don’t think for a minute that this bubble, or any bubble for that matter, is not egged on by those insulated from it’s poppings consequences.

When millions of people lose their jobs and homes, yes

We’ve been so focused on taxing the wealthy to lower inequality, but maybe the answer is staring us in the face

What if we just nuke the economy to ruins?

and start over, thats probably the only way.

…And do what now?

JPow says this bubble is different though

Evaluation, not value.

Evaluation is the act of putting a value on something

This pedantry is not helpful and does nothing to defray the problem

“Putting a value on something” vs. “Something having a discernable value” is the point.

Do you really think that they can pay 5 trillion dollars, or even the 20% of this, to the the shareholders ?

Thank you. This drives me crazy. Apple for comparison is less then 0.5%

And even Apple consists of a lot of hype and not that much substance.

Concentration in fewer and fewer stocks is what happens towards the end of a bull market, and we’re currently in a bull market that has been running wild for years. My personal opinion is that we’re going to get parabolic price increases with a blow-off top, with the following collapse coinciding with the collapse of the U.S. dollar and destruction of the U.S. as the dominant economic force in the world. The stage has been set with a shrinking economy resulting from a massive ill-conceived trade war and indiscriminate deportation of our low-cost labor force, along with gross fiscal irresponsibility from unnecessary tax cuts and excessive spending giving rise to unsustainable budget deficits. The final nail in the coffin will be the debasement of the dollar by a corrupted Federal Reserve that has lost its independence from the Executive branch. There is a reason that gold, a hard asset viewed as a safety net, is in it’s biggest bull run in history, and that bull has a lot further to run. Things will likely come to a head in the 4th quarter of 2026, or not too long thereafter, and we will then slide into that I’m calling “The Greatest Depression”. May you live in interesting times!

The latest stock run is largely already just the debasement on the dollar, in my opinion.

Don’t you wish that on me Ricky Bobby!

I agree completely with this assessment.

gulp

Great write up but just to conclude:

This is not an “if it will break” but “how fast it will break” issue, because this WILL happen, it’s only a matter of when, and event that won’t be far off anymore now that current LLMs have shown to be a technological dead end.

I mean they aren’t a technological dead end just as they aren’t a technological panacea.

You can absolutely use them as coding assistants. They can be used to fool people, sometimes quite effectively. There is definitely “something” going on under the hood even if we don’t want to use words traditionally applied to the human experience like"learning" or “intelligence”. There is a surprising amount of consilience in current models, where you train to get good at task A, but also get good at task B, for no obvious reason.

It’s clear to me no amount of paper mache smearing over the half-glass of wine issue fixes it. There is something fundamental to the “gappiness” present in llms both knowledge set and appearance of logic. It’s becoming clear this is something intrinsic to the architecture and gluing in hot fixes isn’t going to change that. There is some very real underlying weirdness (sea horse emoji). Context windows still only create the mirage of global states (and maybe with a large enough window this doesn’t matter (relative to a human perspective). It’s also clear that nothing about llms or transformers overcomes basic principles of entropy or information theory: you can’t just model noise like some kind of infinite training cheat code.

From where we were (lstm’s) to where we are, they are easily a 100x improvement. ML now is MUCH better than ML 10 years ago, and it has everything to do with transformers.

When llms came into the scene, attention and transformers were not new. but it was a new approach to training them, and creating some clever things to get them to generalize, along with making them utterly massive. But “Attention is all you need” had been published quite a while before this generation, and I promise, if Google has seen the potential, they would not have released that research.

There will be stepwise and generational improvements to AI and ML. even though transformers are what broke through to the mainstream, the progress is much more linear and continuous than it might at first appear. So we shouldn’t expect transformers to be the end state, nor should we expect the next major jump to come from them, or even necessarily something novel. it may be the tools for the next big jump are already here, just waiting to be applied in a clever way

Or maybe this bubble is no different from past tech improvements: mostly small changes over time, occasional big steps, certainly not linear or predictable. In other words, even if most of what you wrote is true, the bubble itself is still a complete failure.

I don’t think anything I wrote has bearing on this being a bubble or to what extent other than it’s clear that what we have now isn’t what those working to get people to invest further in the bubble claim it to be.

Usually when people are out there claiming it’s not a bubble is just before it pops.

You got a source for that last sentence? I’m inclined to degree, but I’d love to see a a concrete explanation proving it.

I’m not going to spend time on how dumb it is to compare a speculative total valuation to the real economic output of a single year.

If we zoom out, it’s not that surprising that emerging tech is going to require greater and greater computing power. We thought that our desire for our laptops to be faster was driving this, Moore’s Law, whatever. But now there’s a new technology that seems to raise the requirements by an order of magnitude. In the short term, this is fantastic news for the makers of computer chips. We’re living in the late Information Age. Is it all that surprising that there would be moments like this where our ability to consume computing power outstrips our ability to produce it? So Nvidia has a high valuation. BFD. Investors are confident in its future. That doesn’t make it 16% of the US economy.

I have similar concerns, comparing gdp to valuation seems nonsensical. But at the same time the valuation is still ludicrous. Nvidia designs chips, TSMC makes them, datacenters buy them, datacenters sell the compute to AI vendors like openai who sell services to customers for a price that doesn’t cover even a fraction their costs, let alone being profitable.

In my book, either two things will happen. Before the money runs out, the AI companies will hit their stated goal of AGI, but without doing any of the safety work, and then everybody dies. The money running out and GFC 2.0 is the “good” ending. If I was even remotely confident in my ability to guess the timing of how it would all play out I’d be shorting up to my eyeballs.

Don’t feel bad. I don’t think shorting can do any good. Betting we won’t need powerful chips in the future seems like a bad bet. The main scenario where we won’t is if we’re all dead, in which case all stock market bets are worthless anyway.

I can say that nvidia is way overvalued and that it’s share price is going to go down without saying that we won’t need powerful chips.

Don’t tell me. Go short the stock and make a million.

As I already said, it’s impossible to time it and you’d be an idiot to try. There could be three more years of bubble first in which case shorting on margin would be ruinous. “Markets can remain irrational a lot longer than you and I can remain solvent” yada yada.

When do you hit tulip level?

This is the exact type of thing you see near the peak of a bubble.

I just read scion capital, Michael Burry, just put in a lot of short positions in Nvidia and Palantir

Totally not a bubble. At all.

totally not a bubble though.

When once in a century depressions become normal and not being in one is the once in a century event.

But what LLM wrote this?

We learned nothing? lol my dear friends.

THEY learned how to do it better and we the people learned to bend over and take it.