- 42 Posts

- 6.43K Comments

5·3 hours ago

5·3 hours agoThe main players in the Middle East have been fighting for the last 3,000

That’s wildly ahistorical.

What you’re describing is the Ottoman Empire, a region that was largely stable and peaceful for centuries.

7·3 hours ago

7·3 hours agoIn and out. Twenty minute quagmire.

You can just withdraw if things go bad, because it’s not like Iran will continue to bombard US and Israeli bases if we just shout “Time Out” loudly enough.

2·3 hours ago

2·3 hours agoSpeed running the Tet Offensive in weeks rather than years

1·4 hours ago

1·4 hours agoIt’s so simple even a Republican can use it

3·11 hours ago

3·11 hours agothey were within their rights to refuse to do business with the US government, and I don’t agree that the response to them refusing it should be the US government blacklist their company

I mean… you want to refuse business but you don’t want to be refused business?

How does that work?

101·11 hours ago

101·11 hours agoThey’re just trying to get clicks. It’s attention seeking behavior, not real concern for public policy.

FIRE has always been a corporate friendly libertarian-right organization. They post this stuff because they need to appear relevant to their sponsors.

4·13 hours ago

4·13 hours agoEh. Depending on where those parts were sourced…

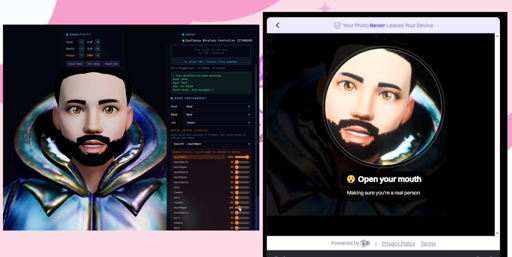

Or it wasn’t. Very possible he was simply gifted the NFT and lied about the price.

A bunch of the early 20s NFT sales were wash sales

45·1 day ago

45·1 day agoWho is going to remove it? Trump’s friend Tim Cook? Trump’s friend Jeff Bezos? Trump’s friend Sundar Pichai? Or Trump’s friend Satya Nadella?

2·1 day ago

2·1 day agoSo yes, you can visit your favorite blog, but its still not the same as it was in the 90s or early 00s.

It absolutely is. I might argue podcasts have kinda usurped the old blogging space (or, at least, supplanted it). But I’ve got an RSS feed full of blogs I follow that are barely different that what I was looking at 30 years ago. The 90s is alive on Feedly.

Fucken computers bullshit, its fucken sick

Lolz.

16·1 day ago

16·1 day agoWhat, no Microslop?

No way this runs on Windows. It’s Linux or bust.

2·1 day ago

2·1 day agoOne method was to lower the quality of inputs. Plywood instead of hardwood. Then fiberboard/chipboard instead of plywood.

In fairness, hardwood is in limited supply. It takes a long time to produce, is expensive to harvest correctly, and typically means demolishing old growth forests to obtain. The “lower quality” products definitely have their trade-offs, but a lot of the quality issues are resolved through engineering improvements and materials sciences.

I would argue the real downside of lower quality inputs is the advent of “disposable” furniture (the IKEA brand crap most notably). Stuff that could have been designed to last, but isn’t, and ends up in landfills after moving day as a result. Rather than a savings yield, what you get is a waste surplus.

And later, CNC machines stepped in to produce delicate and complicated designs in a fraction of the time - and frequently even more precisely and more cleanly - than anyone with a carving chisel could do.

And that is the part which is NOT being effectively duplicated in IT.

Lolwhut? We’ve come so far even in the last ten years, in terms of IDEs, deployment pipelines, and automated unit testing.

7·1 day ago

7·1 day agodont browse

the webFacebook or anymodernGoogle/iPhone Store apps.The internet used to be a space for weird geeky hobbyists that more traditional plebs couldn’t access or couldn’t be bothered to fuck with. Now it’s still that, but it has a bunch of shit for the rubes, too.

At some point, I feel like I’m talking to someone who says “I fucking hate Florida. Every time I go, I spend a week at Disney World and it’s expensive and awful and loud and stupid.” And here I am, out in the Keys, working on my tan and fishing and hiking and hooking up with cuties, having no problems whatsoever.

5·1 day ago

5·1 day agoWe are not at the end of the road. We are not at the beginning of the end of the road. We are not at the end of the beginning.

I definitely get the impulse to doom. And I’m as prone to it as anyone. But when I look at crypto and AI, all I can see is the same analog fuck-ups made in prior generations. Beanie Babies and Labubus didn’t ruin the stuffed animal industry. The Delorean and the Hummer didn’t ruin the automotive industry. The Great Depression of 1932 didn’t ruin the financial sector.

Plenty of things to be excited about in software and tech that lives entirely outside the cloistered hype-beast market. Raspberry Pis, 3D printers, 3nm chipsets built with ultraviolet lithography, solid state drives, lithium and sodium ion batteries with incredibly recharge rates, gorilla glass and carbon fiber, 5G+ radios, full voice recognition, self-piloting vehicles.

How is none of this thrilling? Hell, even just the advent of coding pipelines that can take a project from a funky coding idea to a deliverable feature in a few keystrokes is such a huge step forward in development. I can’t hate the sales goons pushing junk when I’m so immersed in all the novel innovative applications of technology I’ve been watching bud itself up from the ground for the last 40 years.

Even LLMs on their face are such a novel application of graph theory. You can do so much cool stuff off a second hand laptop today. It’s an exciting new frontier.

19·2 days ago

19·2 days agoThey trained a tiny patch of neurons to respond to low-voltage electric impulses. The cells don’t know they’re playing Doom. They don’t have any kind of social context or even video feedback.

Imagine if I stuck you in a sensory deprivation chamber, handed you an NES controller, and asked you to hit the buttons. Then, periodically, I said “Yes” or “No” based on the buttons you pressed. And when I pulled you out of the tube at the end of an hour, I told you “the yes and no messages were intended to encourage you to correctly navigate Mario through the first level of the original game.” What if, instead of Mario, I’d been telling you how to play Street Fighter?

It doesn’t matter if its Doom. They likely picked Doom because the I/O is so rudimentary that you can install the game on practically anything. The cellular matter has no idea what it’s doing beyond the “Yes/No” signaling.

I mean, I wish that were actually true.

One of the bleakest turns of the post-war Eastern Bloc was the speed at which they re-incorporated ex-Nazi officers into the Stasi. I’d have to dig it up, but there’s a whole line about a German describing his career as roughly “First I worked for the monarchy to suppress fascism, then I worked for the fascists to suppress communism, then I worked for the communists to suppress capitalism, and now that the communists lost I’m old enough to retire.”

93·2 days ago

93·2 days agoBuilt to Fail: The story of 21st century consumer technology.

That’s the one.

“For instance, on the planet Earth, man had always assumed that he was more intelligent than dolphins because he had achieved so much—the wheel, New York, wars and so on—whilst all the dolphins had ever done was muck about in the water having a good time. But conversely, the dolphins had always believed that they were far more intelligent than man—for precisely the same reasons.”

Deliberately formed a number of minority controlled governments, with a mandate to kill the majority ethnic group if they got out of line.

Israel was one of these, but hardly the only one.